Nvidia stock jumps on better-than-expected results and outlook

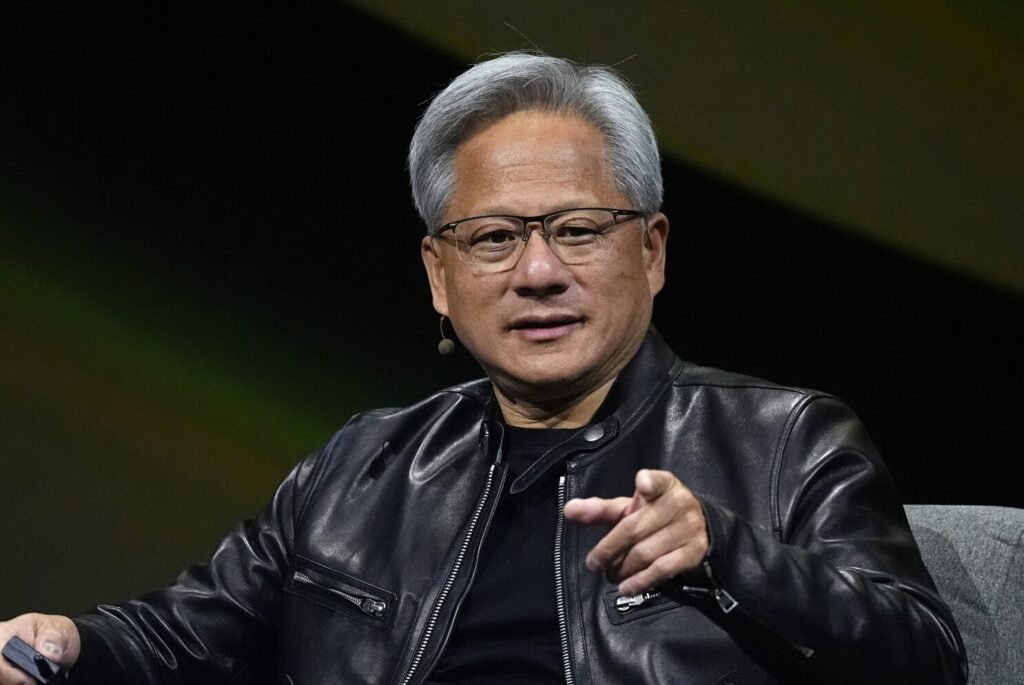

FILE - Jensen Huang, chief executive officer of Nvidia, speaks at SIGGRAPH 2024, in the Colorado Convention Center on July 29, 2024, in Denver. (AP Photo/David Zalubowski, File)

Chipmaker Nvidia topped Wall Street expectations for both quarterly revenue and its sales outlook, easing investor worries about massive AI-related spending that has recently rattled markets.

In results released Wednesday, the company reported a 62% jump in revenue to $57bn for the three months ending in October, fueled by strong demand for its AI data-centre chips. That segment alone generated more than $51bn, up 66% from a year earlier.

Nvidia also projected fourth-quarter revenue of about $65bn, beating analyst estimates and lifting its shares roughly 4% in after-hours trading.

As the world’s most valuable company and a key indicator of the AI boom, Nvidia’s performance is closely watched. CEO Jensen Huang said demand for its AI Blackwell systems was “off the charts,” noting that cloud GPUs are “sold out.”

Addressing speculation of an AI bubble, he told analysts: “From our vantage point, we see something very different. We excel at every phase of AI.”

The report drew heightened scrutiny amid growing fears that AI stocks may be overvalued—concerns that have contributed to four straight days of declines in the S&P 500 and a nearly 3% drop so far this month. Expectations were already high going into Nvidia’s results.